testing

Getting Organized can save you so much Money!

Measuring Cups (4 INCLUDED- 250 ML Each)

* Dishwasher Safe, Freezer Safe, Microwave Safe (Remove Lid)

* Stackable Design

* Non-Slip & Sealing Lids

* BPA Free

* Reusable & Durable

- I love that I can see what is in these containers

- It is fun with the chalk labels

- I love that it comes with measuring cups

- Square containers give you more room in the pantry

- You do lose a little space in the pantry by being organized

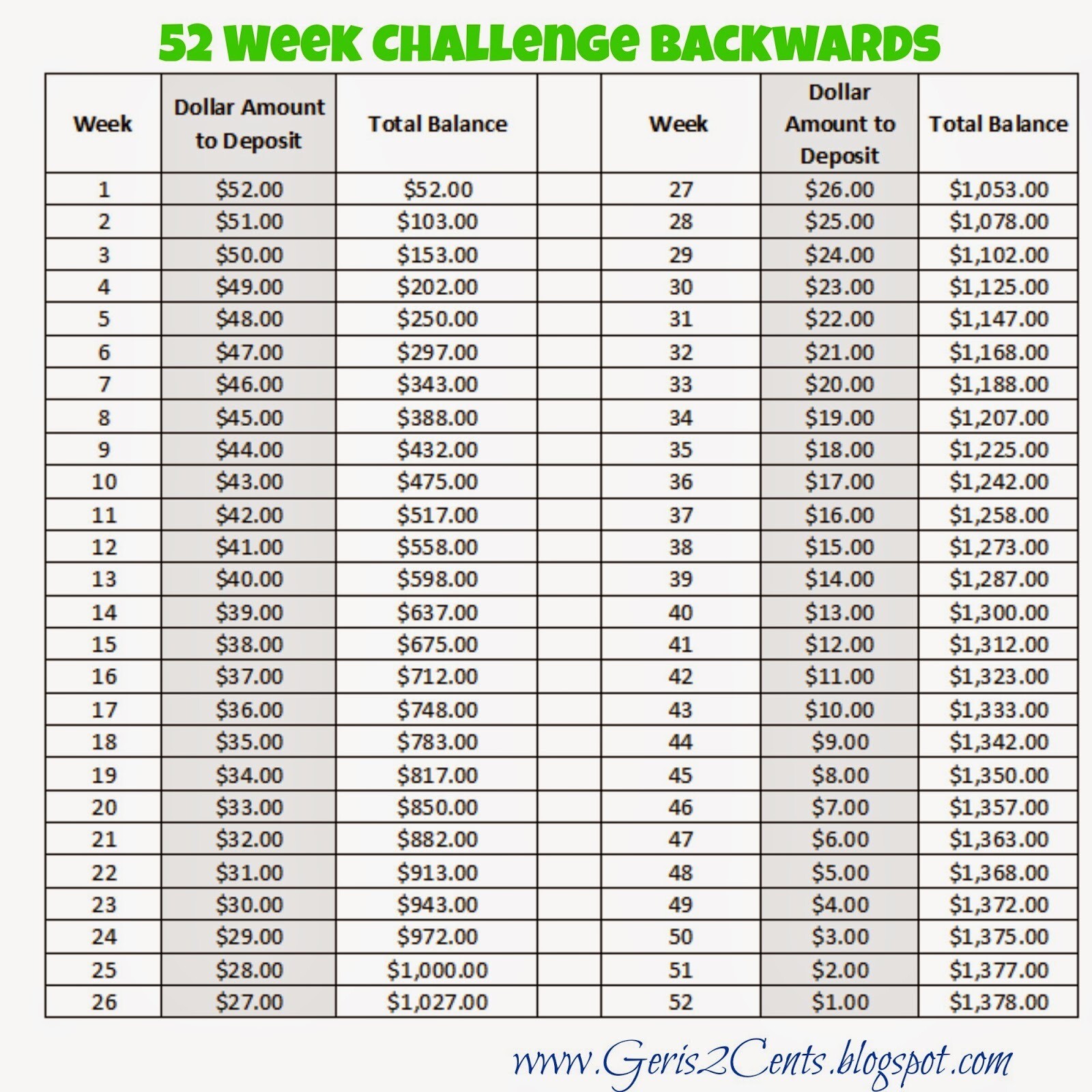

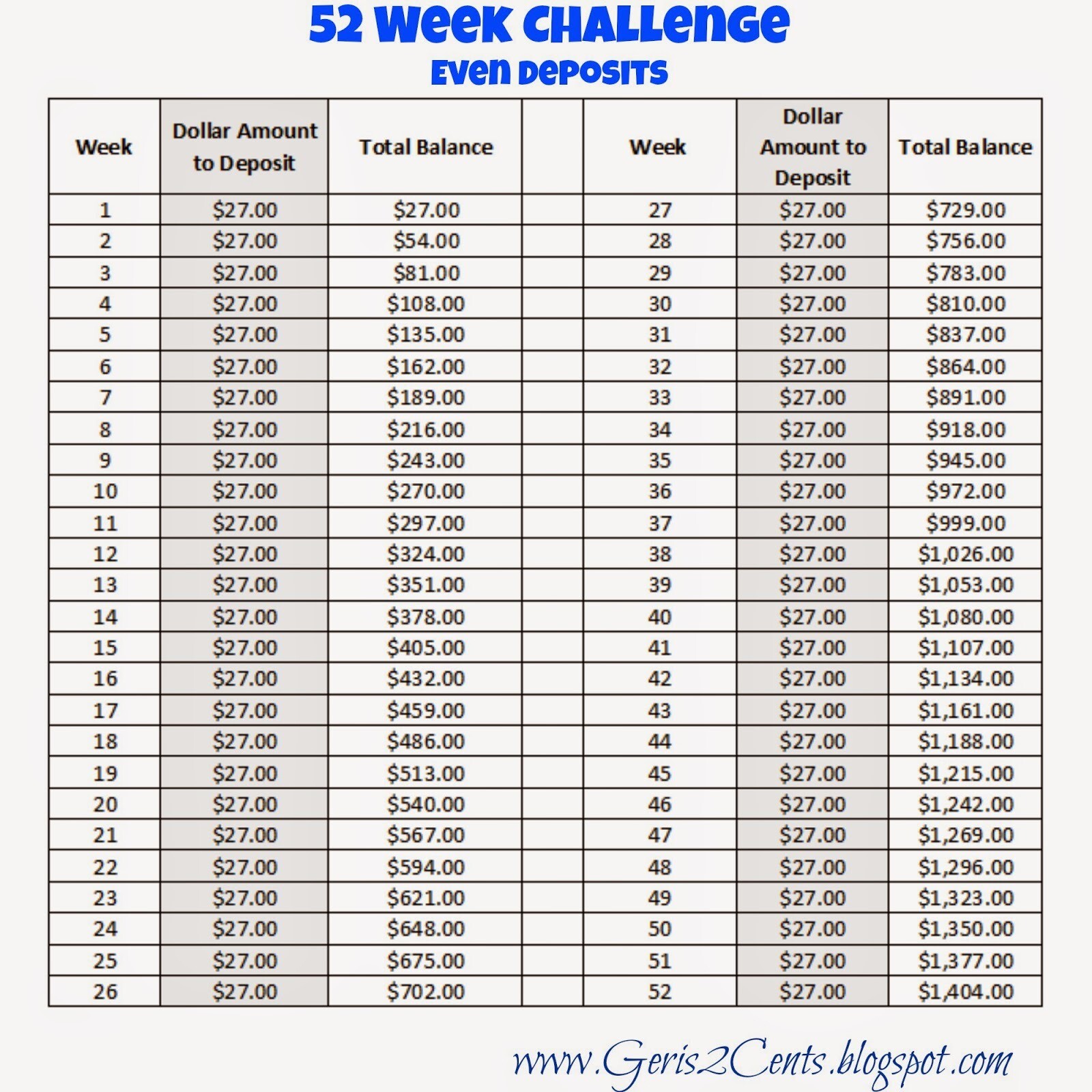

Debt Free Living: 52 Week Challenge!

It's that time of year again.

YMCA Las Vegas Family Activities plus a Free Week Trial

If you haven't checked out the YMCA Las Vegas, what are you waiting for?!? Here is a week trial just for you. Click on this link and fill out the info. You will be glad you did.

How to Add to Your Classic Happy Planner

At the print screen:

- be sure to change the CUSTOM SCALE to 83% and

- make sure that the orientation is PORTRAIT. (That way the text is not only smaller size but it also placed in the top left part of the page.)

- Then I grab my scrapbooking paper cutter and cut off the right side and bottom to match up with your Happy Planner.

- Then I punch the holes on the left side and you are ready to go.

- Adding papers you want and need into your datebook.

Babysitting Training Course for Teens at the Y

I am just blown away by all the different things the Las Vegas YMCA offers! They have events for Families, Parents, Hikes and so much more.

Calling all teens! This one is for you!

The Skyview YMCA is offering 2 American Red Cross Babysitter's Training courses in the next couple of months!

This training course will help provide youth that are planning on babysitting with the knowledge and skills necessary to safely and responsibly give care for children and infants. They will become certified in pediatric CPR and First Aid when they pass the written and practical exam. This training is designed for kids ages 11 to 15.

The American Red Cross Babysitter's Training course will help participants develop leadership skills; learn how to develop a babysitting business; keep themselves and others safe; help children behave; and learn about basic child care and basic first aid.

I wish I knew about a training like this when I was a teen. I would have loved to turn my babysitting the neighbors son into a real business. That would have been amazing! It might be too late for me, but if you are teen (or know one) be sure to check it out. You can click this link to sign up or get additional information.

The next 2 courses at Skyview YMCA in Las Vegas are on:

November 11, 2022 - Nov 12, 2022 and

December 9, 2022 - December 10, 2022.

A Simple Plan For DEBT FREE

- This is not one of those courses that tells you can't have fun ever again.

- This is not a course that is boring and hard to follow.

- This course has quick, easy and simple steps in order to get that financial plan up and running.

- This IS a group of like minded people that are working on similar goals, and they are simple. Plan your money!